For anyone holding digital assets, finding a safe way to store your crypto should be your primary concern. This is because failure to do so will likely result in the irretrievable loss of your hard-earned assets, either as a direct result of your own actions or those of a bad actor, like a scammer or hacker.

To this end, storing your assets safely is all about securing your private keys. These are cryptographic keys that prove ownership of the funds associated with a particular wallet address. They are, therefore, used to sign transactions. Think of them as a digital signature that gives anyone who has them access to a wallet and all its funds.

So generally, the safest ways to store cryptocurrencies are those that offer the most security to your private keys. Different types of wallets do so to varying degrees. This article will cover the different categories of crypto wallets while highlighting the safest options under each.

Best hot wallet to store your crypto

A hot wallet is any type of crypto wallet that is always connected to the internet. Examples include Metamask, TronLink, Rabby Wallet, Trust Wallet, and many more.

Their connection makes it convenient to access and conduct transactions with your funds. But, it exposes the wallet to significant security risks, like hacks, malware attacks, and phishing attacks. This makes hot wallets the riskiest way to store cryptocurrencies.

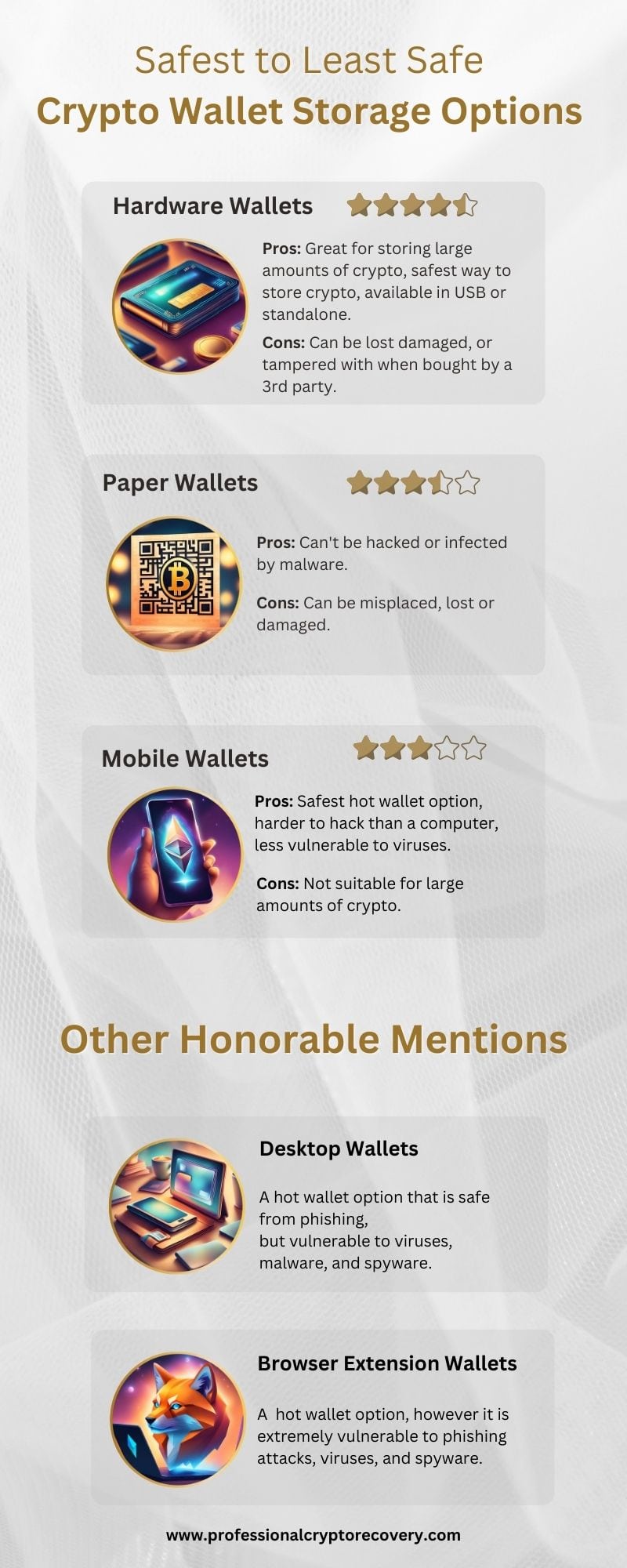

Still, some hot wallets are riskier than others. For example, wallet browser extensions are the most vulnerable to phishing attacks. A user can be easily tricked to connect to a fake platform and authorize access to their assets. They’re also vulnerable to viruses and spyware designed to steal your private keys.

Desktop wallets, those installed as applications on your computer, are much safer from phishing attacks. However, they are equally vulnerable to viruses, malware, and spyware.

One way to avoid these risks is to use a custodial wallet. This is usually a wallet on a crypto exchange, like Binance and Coinbase. It is called custodial because the platform stores your private keys on your behalf, giving the platform control over your funds.

The downside to this option is that such platforms tend to hold a lot of crypto assets, making them a popular target for hackers. Mt. Gox, a popular crypto exchange in the early 2010s is a good example of this. However, the biggest risk of custodial wallets is the platform going out of business due to mismanagement. If that happens, as was the case with FTX, you will lose access to all your funds.

So, what is the safest option when it comes to hot wallets?

That would be mobile wallets.

Mobile wallet: safety rating 3/5

These are non-custodial wallet applications that you install on your mobile phone. They’re the safest hot wallet option because phones are less vulnerable to viruses and much harder to hack than computers. It’s also difficult to fall prey to phishing schemes since the only way to access a trading/investing platform is via the wallet’s inbuilt browser, which has built in links to legitimate platforms.

Cold wallets

Cold wallets are those not connected to the internet. By staying offline, they keep your private keys protected from hackers and malware. This makes them a much safer way to store your cryptocurrencies. They do have their risks though, which will be discussed later.

There are two types of cold wallets; paper wallets and hardware wallets.

Paper wallet: safety rating 3.5/5

A paper wallet is created by printing the private and public keys of a crypto wallet on a piece of paper. Since it is impossible to hack a piece of paper or infect it with malware, paper wallets are considered very secure.

However, paper is very easily damaged. This makes it easy to lose your crypto. To mitigate this risk, you are encouraged to create multiple copies of the wallet and store each in a different safe location, like a safety deposit box or vault.

It’s also important to note that paper wallets are only truly secure when created on an air-gapped device. Such a device has zero external wireless or wired connections– no internet, Bluetooth, or local area network (LAN), to ensure that no one can snoop and steal your keys during the process.

On top of that, the computer should be booted from a USB/flash drive. This basically means that the device starts up using an operating system (OS) that is stored on the USB/flash drive. Once the operation is over, the USB/flash drive is never used again.

Hardware wallets: safety rating 4.5/5

Hardware wallets are physical electronic devices designed for storing crypto. They’re primarily available in two form factors; USB sticks and standalone wallets. The former needs to be inserted in a computer to be used while the latter can be used as a standalone device, like you would a mobile phone.

Hardware wallets are generally the most secure way to store cryptocurrencies, especially if you’re holding large amounts. Users can enhance this security by using a passphrase. This is a feature that creates hidden wallet addresses that no one can access, even with the seed phrase.

But even with all that, hardware wallets are not perfect. There are some risks, like physical damage or misplacing the device, that can result in asset loss. And if you buy the wallet from a third party, there is the risk that it has been tampered with.

Therefore, you are advised to buy your hardware wallet directly from the manufacturer and handle it with care to avoid physical damage. You can keep it locked in a safe when not in use to ensure maximum safety from theft and damage.

And then there is the concept of deep cold storage. This is only if you want to put crypto away for a long time. Like, a “willing it to your heirs” timeframe. The process involves using a cold storage device and using the most extreme measures to safeguard your seed phrase. Very few people take this route, though.

Popular hardware wallet brands include Ledger, Trezor, and CoolWallet.

Storing your seed phrase

Choosing the safest wallet option is only half the trick. Equally important is storing your wallet’s seed phrase and/or passphrase. These give the holder complete access and control of a wallet. So, you’ll want to store these somewhere that thieves and hackers can’t reach.

This means that storing your seed phrase online, like on the cloud, a Google doc, or even on a computer that’s regularly connected to the internet is not an option. Your best storage option is one that’s completely offline.

The most common method is to write your seed phrase on a piece of paper. This doesn’t completely eliminate the risk of it falling into the wrong hands. So, you want to store that paper securely in a safe or safety deposit box. You can even split the phrase into two halves and store each in its own safe or create multiple copies and keep each copy in a different secure location.

The same can be done with your hardware wallet’s passphrase. However, never store the seed phrase and passphrase in the same location as the device.

So, what is the best way to store your assets?

While there are many ways to store crypto, it is generally accepted that the safest options are those that keep your private keys offline, away from the prying eyes of hackers, and out of reach of phishing scams. Cold storage solutions, like paper wallets and hardware wallets, are considered very secure because they do just that.

That doesn’t mean there is no safe hot wallet. Among hot storage solutions, mobile wallets provide the highest security because phones are generally a harder platform to hack. And, if you’re conducting a large number of transactions, the convenience of a hot wallet might be the most important thing.

But whatever option you chose, keeping your seed phrase and/or passphrase is of absolute importance. And in the unfortunate instance of something happening to your crypto, call a professional crypto recovery agency to see what they can do for you.