The crypto space is a valuable market. With 10,000+ cryptocurrencies spread across 1,000+ blockchains and at least 560 million users, it is valued at more than 2 trillion dollars. This has made it one of the most exciting markets for investors, financial institutions, and even governments.

But for the same reasons, it has also attracted its fair share of criminals, with hacks and scams a relatively regular occurrence. So, security is one of the industry’s biggest concerns. Let’s see what the statistics say.

Over 20% of Bitcoin Is Considered Lost

Bitcoin (BTC) is not only extremely popular, but it is also the most valuable crypto asset out there. Over the years, a surprisingly large number of bitcoins have been lost, though. The exact number and value are not known, but the blockchain analysis platform IntoTheBlock estimates that 29% of BTC hasn’t moved in 5+ years.

While some of this BTC is certainly in the hands of investors who are Holding On for Dear Life (HODLing), experts believe that a large portion of it is lost. These are coins in wallets that owners can no longer access for one reason or another and many are thought to be lost forever. But that doesn’t mean it is impossible to recover BTC stuck in a wallet.

Depending on your specific situation, a crypto recovery expert can help you get back the BTC stuck in your wallet.

The Value of Crypto Stolen Grows in H1 2024

Reporting on security stats, Beosin says total losses caused by hacks and scams in the first half of 2024 in crypto stands at $1.54 billion. This is a more than 100% increase from the $670 million stolen in H1 2023, although it should be noted that rising crypto values likely inflate the more recent figures.

Overall though, this signals a reversal from 2023. Data from Chainalysis shows that $1.7 billion was stolen last year, a 54.3% decline from the previous year, which was the worst year in crypto security. The space lost approximately $3.7 billion in 2022.

The Chainalysis report cites a fall in DeFi protocol hacks as the main reason behind 2023’s decline in exploits. The high losses in 2022 likely prompted a significant upgrade in preventive and responsive security measures.

As such, the value lost in protocol hacks declined by 63.7% year-over-year in 2023, though the bear market also influenced the figures. If the second half of 2024 is like the first, this trend should reverse.

Centralized Platforms Suffer the Highest Loses in H1 2024

The report by Beosin also found that centralized exchanges (CEXs) suffered the highest losses among crypto platforms in H1 2024. There have been four CEX-related incidents so far. These resulted in a total loss of approximately $392 million, accounting for 32.8% of losses so far this year.

This is in sharp contrast to last year. According to CoinTelegraph centralized platforms lost an estimated $256 million across 7 cases throughout the year.

Gaming platforms are a close second having lost $389 million following an increase in attacks. This represents 32.6% of the total loss. DeFi, on the other hand, has lost $157 million (13.2%) after 38 incidents (the most of any project type).

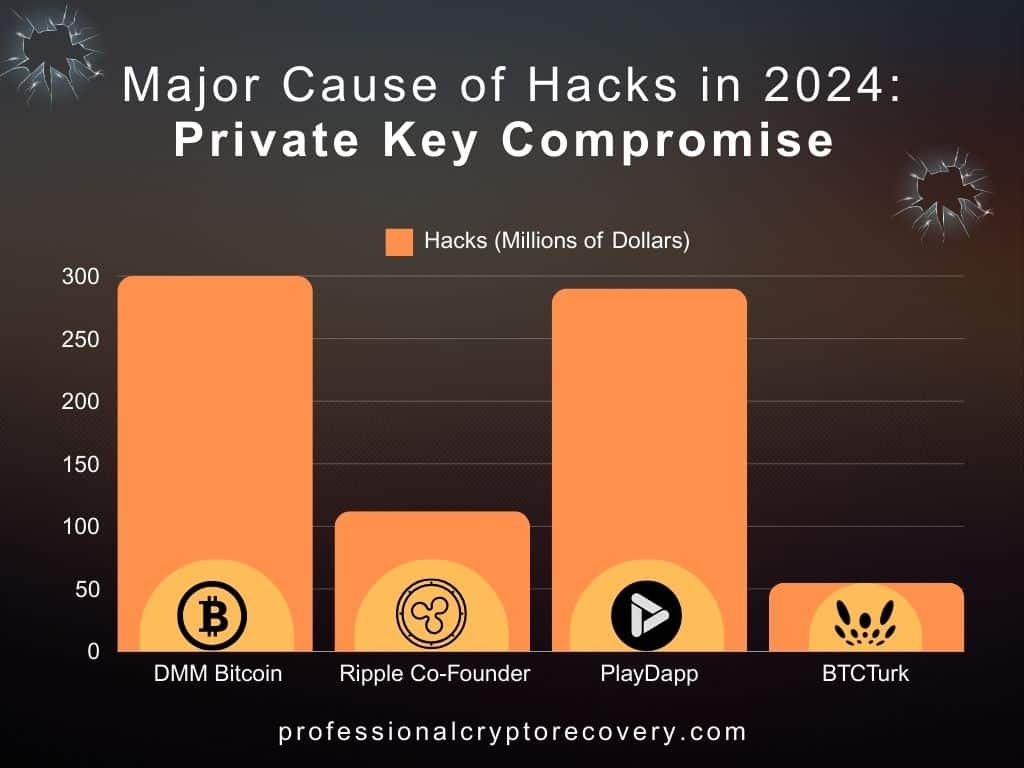

Compromised Private Keys Were Responsible for 75% of Hacks

According to Chainalysis, compromised private keys were responsible for 33% of DeFi hacks in 2023. Private keys are a wallet’s master key. They give anyone who has them total access to the assets contained in the account. As such, they are a valuable target for hackers and scammers online.

These figures have dramatically increased according to Beosin, who reports that private key compromise accounts for 75% of total losses in H1 2024. Some major private key incidents this year include DMM Bitcoin ($300 million), Ripple co-founder Chris Larsen ($112 million), PlayDapp ($290 million), and BtcTurk ($55 million).

Atomic Wallet Users Lost $129 Million

In July 2023, the non-custodial Atomic Wallet was hacked for approximately $129 million. The specifics of the attack remain unclear but it is believed that the hackers compromised users’ private keys and seed phrases. This allowed them to access and transfer victims’ funds.

The FBI attributes this attack to TraderTraiter, a North Korea-affiliated hacking group that they also believe to be behind the Alphapo (a crypto payment processor hacked for $23 million) and Coinspaid (a crypto payment gateway hacked for $37 million) attacks.

TraderTraiter’s ties to North Korea represent a trend that’s common in DeFi but one that was on the decline by the end of 2023.

The Number of North Korea-Linked Hacks Climbs While the Total Value Stolen Drops

North Korea-affiliated hacker groups have been a thorn in crypto’s side for some time. The most infamous, the Lazarus Group, is responsible for some of the largest hacks in DeFi history. Other groups include Kimsuky and TraderTraiter.

These hacker groups hit the most targets ever last year with 20 hacks. They stole 58% of the record $1.7 billion they managed in 2022. This included $127 million from wallet providers, $150 million from centralized services, $330.9 million from exchanges, and $428.8 million from DeFi platforms.

Ethereum Lost the Most to Hacks

The annual 2023 report of the security app, De.Fi, puts the total value lost to crypto hacks, scams, and exploits at $2 billion. According to the report, the Ethereum blockchain was the most affected in 2023, losing an estimated $1.35 billion in about 170 incidents.

BNB suffered 213 incidents that cost users assets worth around $110 million while zkSync Era and Solana lost $5.2 million (two incidents) and $1 million (one incident) respectively.

In 2024, Ethereum is still the blockchain with the highest loss amount. The network has witnessed a total of 32 incidents causing $470 million in losses. This figure accounts for 39.4% of total losses in H1 2024.

Approval Phishing Scams Grew in 2023

Approval phishing scams involve schemes where scammers trick the victim into giving the scammer’s address permission to spend certain tokens in the victim’s wallet. According to data from Chainalysis, victims lost an estimated $374.6 million to these scams between January and November 2023. This was a significant drop from the $516.8 million lost in 2022.

Chainalysis tracked the approval phishing revenue of 1,013 addresses between May 2022 and November 2023. The most successful of these stole an estimated $44.3 million from thousands of victims, accounting for 4.4% of an estimated $1 billion stolen during the study period. In total, 73 of the biggest addresses accounted for half of all the value stolen.

Outlook H2 2024

2024 has already seen an uptick in the amount lost to hacks and scams. In part, this can be attributed to higher valuations of cryptocurrencies compared to 2023. However, a bear market will also bring out more hacks as prices continue to rise.

As such, security remains an important consideration for anyone in the crypto space. Whether you’re a trader, investor, or protocol, taking measures to protect your assets is crucial. This means keeping your private keys safe; some of the biggest hacks this year were enabled by compromised private keys.